Emperor Blog

IP Balanced Fund

Emperor Asset Management runs a variety of investment strategies. In this article, we focus on our balanced fund, the IP Balanced Fund. This fund has recently been added to the Glacier investment platform.

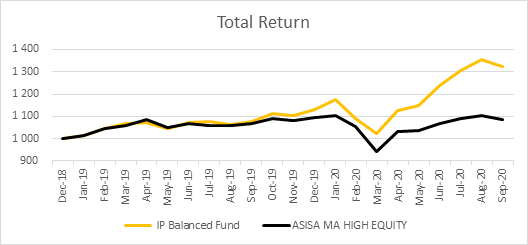

We are proud of the performance of this fund; although a relatively recent fund, it is one of the best performing unit trusts in its category, for example, this year (1 January to 30 September) the fund has returned 16.96% compared to the ASISA Multi-Asset high equity average return for the year is -1.6%.*

The Emperor Approach

Before we get into the analysis it is important to understand Emperor’s investment process and philosophy. We are a data-driven, algorithmic asset manager. What this means is that we utilize technology to sift through and analyze data in the market, this can be both technical stock market data, such as changes in price and volatility, as well as be fundamental data, such as changes in companies’ free cash flow generation, book value, reported earning, etc.

We create our balanced portfolio by first running our algorithm to determine what the optimal asset allocation is to cash, bonds, local equities, property, and foreign equities based on the relationships between those assets today and over time. We then combine our equity building blocks based on a similar analysis to arrive at our equity holdings.

The Portfolio

Now that we have gone through our approach, we can dig into what this means in practice.

At the beginning of the year, we had approximately a 25% weighting to cash and bonds, 25% weighting to offshore equities with the remainder in local equities. In local equities, our major exposure was to materials (42% of the local equity exposure), financials (28%), and consumer staples (16%). We had no exposure to real estate.

We can see how this has changed over time as COVID hit. We increased our international equities exposure to 30% early in the year while our average sector exposure through the year has remained more or less unchanged but our performance within each sector has added significant alpha. Year to date we have achieved a return of 54% within the materials sector compared to a return of approximately 16% in the sector for the Top 40. Our exposure within the financial sector has yielded a 33% return to date compared to a -32% return within the sector for the Top 40. Unfortunately, we significantly underperformed (by 14%) in the consumer stables category compared to the Top 40, this underperformance was somewhat lessened as we reduced our exposure by 37% during the year to this sector of the market. We have had no exposure to real estate for some time which has been the worst-performing sector of the Top 40 index with a return of approximately -50%. Finally, within foreign equities, we returned approximately 47% compared to about a 24% return for the MSCI World Index in 2020.

We can dig deeper into this on a per share basis. The table shows our top 10 holdings and their average weights this year.

|

Share |

Weight |

Return YTD |

|

Purple Group LTD |

5.37% |

113.89% |

|

Prosus |

4.54% |

45.92% |

|

Gold Fields |

2.86% |

96.59% |

|

Transaction Capital |

2.51% |

4.27% |

|

Impala Platinum |

1.81% |

21.46% |

|

Quilter Plc |

1.63% |

-6.28% |

|

Anheuser-Bush InBev |

1.60% |

-21.88% |

|

BHP Group |

1.45% |

3.27% |

|

Sibanye Stilwater |

1.41% |

45.44% |

|

African Rainbow Minerals |

1.34% |

50.37% |

|

JSE Shareholder Weighted Top 40 Index |

-0.33% |

|

Purple Group is a South African Fintech company. We have maintained our exposure to this stock as we invest in companies, both offshore and in SA, serving millennials' needs, in this case, investments made easy. We like fintech businesses as these companies start to drive their consumer behavior.

Prosus has major exposure to Tencent and we like this stock as we are bullish in China and in gaming stocks more generally which make up a significant proportion of our IP Global Momentum UT. With solid revenue streams, we believe the company stands to achieve long-term growth with their existing and new investments.

Our basic materials holdings include Gold Fields, Impala Platinum, BHP, African Rainbow, and Sibanye Stillwater. We like gold miners due to the money debasing of fiscal and monetary stimulus worldwide, platinum due to industrial uses, automotive catalytic converter exhaust pollution prevention, and petrochemical uses. We like these stocks in particular because of their strong financials and long-term growth potential.

We invested in Quilter as we want domestic companies with high foreign exposure, and we like Quilter as a financial platform. Recent financials show improved net inflows – up 500% to GBP1.2b for the first 9 months in 2020 compared to the same period last year.

Transaction Capital’s profit growth may have been disrupted this year; however, we expect the company will return to generating profits as lockdown restrictions are eased and taxi operations resume. Recently the company acquired a stake in We Buy Cars for R1.8billion.

We have about 30% exposure to offshore companies where we invest thematically in stocks. Our current portfolio consists of e-commerce, streaming infrastructure, and services, cloud services, gaming/home entertainment, mixed retail, and financial technology companies. Our offshore companies have returned approximately 50% year to date.

Our top three holdings are:

|

Share |

Weight |

Return YTD |

|

SHOPIFY INC |

10.0% |

153.3% |

|

NVIDIA CORP |

6.1% |

127.1% |

|

TRADE DESK INC |

5.9% |

133.6% |

|

|

|

|

|

|

|

|

Shopify is a SaaS e-commerce platform allowing customers to create their own online shopping experience customers include Tesla, Red Bull, Nescafe, NY Times, amongst thousands of other large and small companies.

NVIDIA is the leading manufacturer of graphics processors (GPUs) in the world with use cases in gaming, cloud data centers, self-driving cars, AI, and computers. They plan to acquire ARM, a deal that’s likely to give it an edge over competitors.

Trade Desk is one of our favorites and a long term holding. The Trade Desk has become the fastest-growing demand-side advertising platform in the industry by offering agencies, aggregators, and their advertiser's best-in-class technology to manage display, social, mobile, and video advertising campaigns. They have seen significant growth in over-the-top (streaming tv) advertising. The outlook is positive with the increasing demand for data-driven advertising.

This fund has a place in any long-term RA or moderate high investors portfolio. You can access the fund on the IP platform or Glacier.

Happy investing

Emperor

All Performance data sourced from Bloomberg on 22 October 2020.

Disclaimer:

Terms and conditions apply. Emperor Asset Management (Pty) Ltd is an authorised financial services provider (FSP no. 44978). The value of a financial product can go down, as well as up, due to changes in the value of the underlying investments. An investor may not recoup the full amount invested. Past performance is not necessarily an indication of future performance. These products are not guaranteed. This document is for information purposes only and does not constitute or form part of any offer to issue or sell, or any solicitation of any offer to subscribe for or purchase any particular investment. Opinions expressed in this document may be changed without notice any time after publication. We therefore disclaim any liability for loss, liability, damage (whether direct or consequential) or expense of any nature whatsoever which may be suffered as a result for which may attributable directly or indirectly, to the use of or reliance upon the information.