Telkom SA SOC Limited is a South African wireline and wireless telecommunications provider. As a result of a R1,186 million restructuring program and the additional impairment of trade receivables and contract assets due to COVID-19 of R626 million Telkom announced that it expects headline earnings per share to decrease by between 65% and 70% and basic earnings per share to decrease by between 75% to 80% from a year ago. Fixed line voice has continued to be hard hit, now so more than ever due to lockdown.

“The negative impact of Covid-19 on the South African economy is expected to put further pressure on consumers, with studies predicting that a number of customers are likely to default on their obligations as they fall due. As a result, Telkom took a prudent approach … by estimating an increase in customer default rates for our customer base, and this has been incorporated in the calculation of the group’s expected credit losses,” Telkom explained

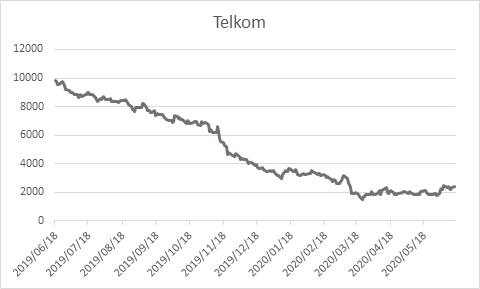

The TKG share price has fallen from R98 a year ago to R24 on the 15th of June 2020, a loss of 75% and this year so far it has shed some 30% of tis value.

Emperor doesn’t exclusively manage long only portfolios on Easy Equities. We also manage long/short CFD portfolios. These portfolios will take long (buy the companies we like) and short (sell those companies we don’t like, i.e. have a negative position) trades. This means investments are made in companies in which the share price is expected to grow, as well as in companies in which the share price is expected to fall – we benefit on both sides.

Chart: Telkom share price in the last 1 year

Source Bloomberg

Until Next Time