Emperor Blog

.jpg?width=7360&name=accomplishment-adult-adventure-372098%20(1).jpg)

September 2018 Market review

September was a month of mixed fortunes. Finally there was some indication that the government was taking seriously the lapse into recession, which prompted the president and finance minister to indicate that some stimulatory steps would be taken. These included a promised relaxation of immigration rules to encourage tourism, and draft Mining Charter regulations that were mildly positive for the sector. However, the promises weren’t enough to offset other disappointments. In the absence of concrete proposals, the market took its cue from nasty surprises regarding the fuel price and the spectre of zero-growth inflation. It is not a happy situation and we have to hope that before the end of the year more encouragement is given to consumers and businesses in order to revitalise the drooping stock market.

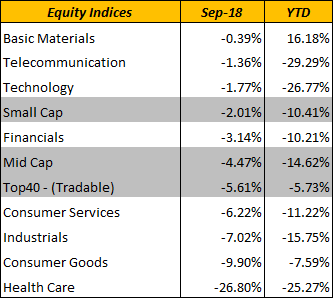

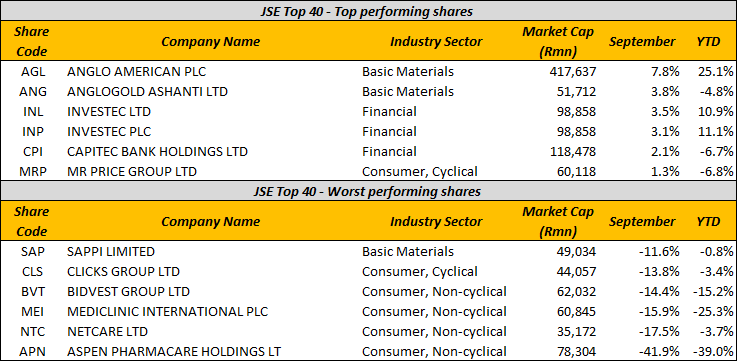

We take some heart from the resilient performance of basic materials stocks, building on their year’s gains again in September. Rand-watchers were again bamboozled: the currency recovered 4% in September but that was on the back of an 11% collapse in August, and it is still markedly weaker for the year. Traditionally this has translated into a fillip for SA companies earning hard currency, but equally the feeble rand hammered consumer-facing domestic companies that were faced with higher import costs and rising producer inflation.

Also worth noting in September was the extreme shock reaction to Aspen’s results. At face value it was due to disappointment regarding the disposal of a non-core subsidiary, but the market punished the stock for perceived dangerous levels of debt. Following a calamitous 42% decline in the share price, the company was moved to issue another SENS announcement to calm fears about its borrowings. The share has since stabilised (at a markedly lower price:earnings multiple) and we will have to see if this former market darling growth stock can recover its former glory. As it was, Aspen’s tumble infected other pharma and related consumer stocks, with Mediclinic, Netcare, Bidvest and Clicks all suffering in September.

On the upside it was good to see Anglo American and Amplats leading the charge for basic materials, supported nicely by Capitec and Investec. With regard to the latter, the market seemed to shrug off the retirement of founding partners Stephen Koseff and Brian Kantor, with perhaps the promotion of new blood in the form of Hendrik du Toit, head of the London-based asset management team, causing fresh investor interest.

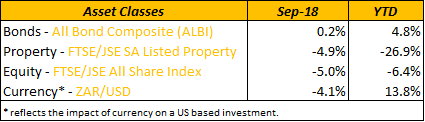

Locally, all asset classes except bonds (flat) ended September around 5% lower, and even worse for 2018 to date. There has been some market chatter that at these levels stocks are beginning to show signs of value, but in the absence of more macro economic stimulation it is hard to see a sustained rebound. A similar picture is playing out across all emerging markets.

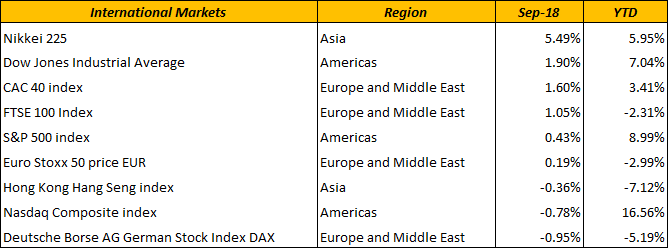

Looking offshore, the US continues to be the guiding light. Although the Nasdaq came off marginally from its heights, the S&P500 held its ground. Across in Europe the FTSE regained some of its annual losses, while Japan’s Nikkei has been remarkably strong all year.

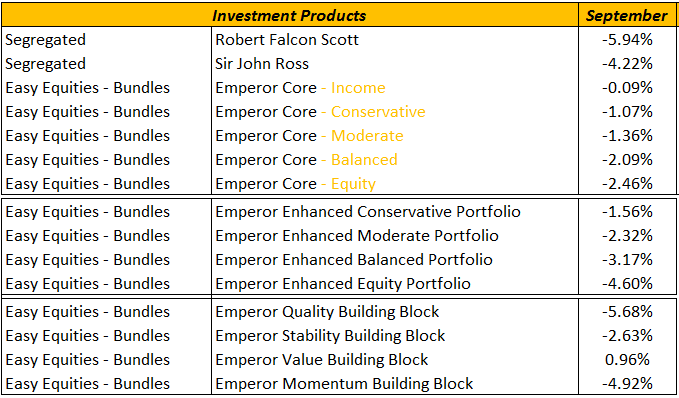

LEVERAGED EQUITY (RFS)

The portfolio lost 5.94% in September, primarily due to its international holdings. Losses were offset by good performances from Santam and Assore.

LONG- SHORT 140/40 (SJR)

The fund was negative in the month, down 4.22%. Offshore holdings were a drag, but short positions in the STX40 and some property shares had a positive effect.

EASY EQUITIES BUNDLES

Bundles exposed to foreign and local equities took an expected hit, but there was a hint of hope in the positive performance of the value building block - could this be a sign that the market is beginning to find green shoots? As always in an equity downturn, more conservative bundles weighted towards bonds and the money market were slightly stronger in September.

TECHNICAL REVIEW

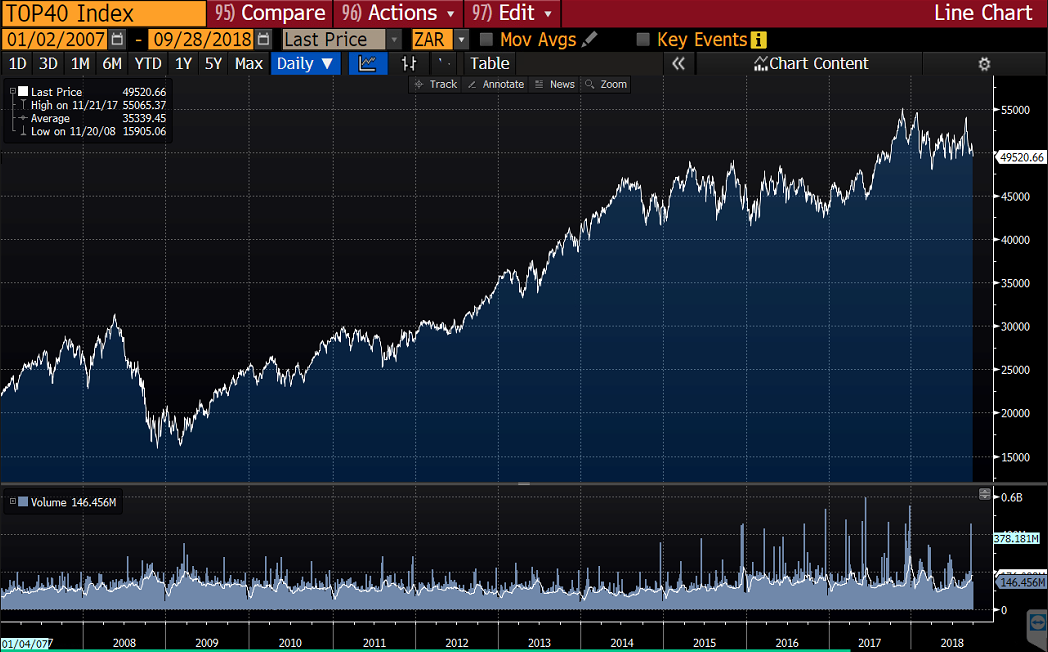

Over the longer term, taken from the point of the global recovery in 2009, the JSE Top 40 index looks pretty good (given the awful political situation we lived through, with all the attendant uncertainty and setbacks). However the market has basically been treading water around the 50,000 level despite some early hopes at the beginning of the year that it would finally burst through 55,000. Now that Cyril Ramaphosa has begun to settle in, market expectations could be said to be building strength - but as always it is foolhardy to hope for too much. In the meantime, strategic stock and asset class selection remain the key to maintaining value and even to eking out gains when the market has a mind to begin its next move.

Happy investing.

Sihle Ndhlala

Junior Fund Manager