Emperor has a fantastic range of managed portfolios in all aspects of the investment space. Whether you are looking for a Tax Free Savings (TFSA), ZAR, USD or Retirement Annuity investment solution, we truly have it all.

With our managed portfolios on EasyEquities, it has never been easier to invest in an algorithmic investment style that aims for absolute returns. We look at how the portfolios have performed in March.

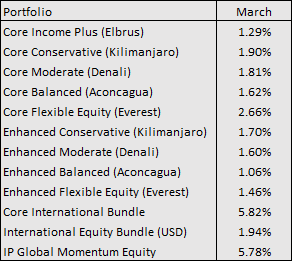

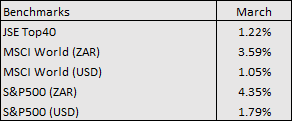

Thanks to Emperor’s momentum and value building blocks, our core range of portfolios outperformed the JSE Top40 in the month with lower risk as measured by volatility. Returns range between 1.29% for the most conservative portfolio and 2.66% for the equity only portfolio.

This month Core bundles outperformed the Enhanced bundles due to our share allocation to the financial and consumer discretionary sectors.

Looking offshore, both the ZAR bundle (5.82%) and the USD bundle (1.94) performed better than their benchmarks at 3.59% and 1.79% respectively. You can compare the Income, Conservative, Moderate and Balanced bundles to similar unit trusts.

Happy Investing

Disclaimer:

This document is for information purposes only and does not constitute or form part of any offer to issue or sell, or any solicitation of any offer to subscribe for or purchase any particular investment. Opinions expressed in this document may be changed without notice at any time after publication. We therefore disclaim any liability for any loss, liability, damage (whether direct or consequential) or expense of any nature whatsoever which may be suffered as a result of or which may be attributable, directly or indirectly, to the use of or reliance upon the information. The value of participatory interests may go down as well as up and therefore is not guaranteed. The past performance is not necessarily a guide to the future performance. Emperor Asset Management is an authorised Financial Services Provider FSP 44978.